Recently, there has been a notable trend among brokers offerings enhanced leverage options such as 1:200, 1:500, and even 1:1000. In response to this trend, clients have been requesting B2Prime, a leading Prime of Prime multi-asset liquidity provider, to adjust margin conditions to enhance their hedging, cash flow management, and implementation of sophisticated trading strategies.

Given that B2Prime’s clients are classified as professionals and market (eligible) counterparties with proper risk management systems in place, the company has decided to increase leverage options and simultaneously implement a tiered margin approach.

This strategic move is the response to the growing demand for comprehensive and bespoke liquidity solutions. The company remains committed to fulfilling this demand and continuously adapting to market needs.

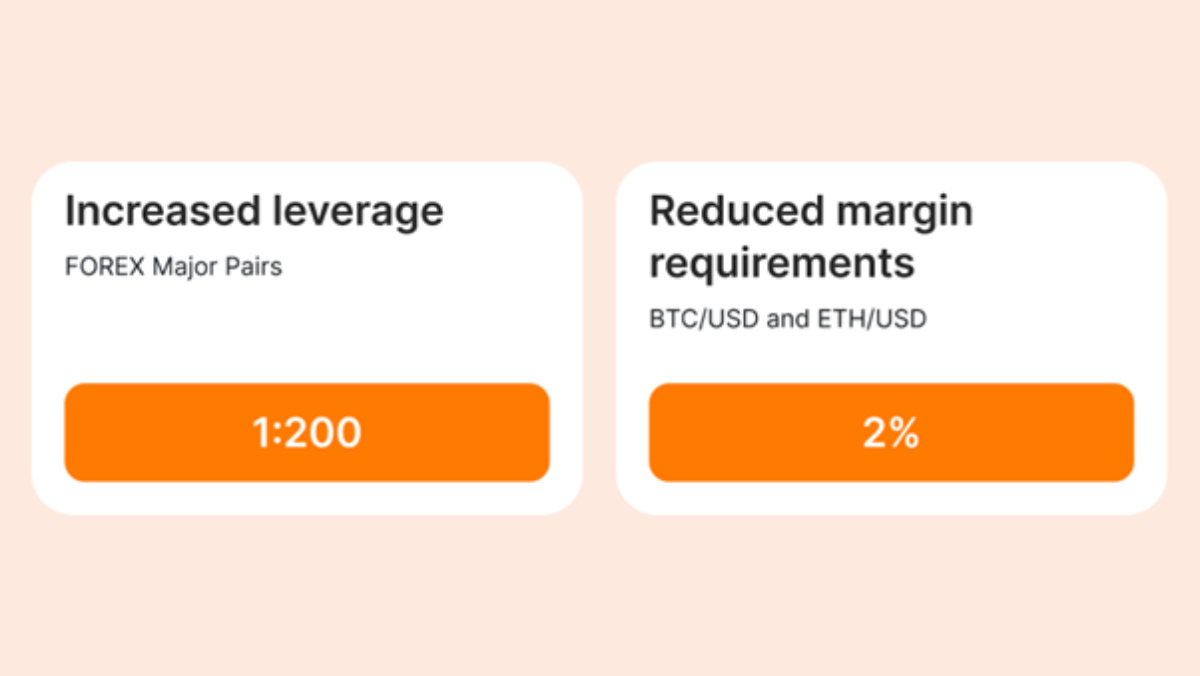

Accordingly, B2Prime is raising leverage to up to 1:200 on major FOREX pairs and up to 1:50 on major crypto CFD pairs.

Nick Chrysochos, Executive Director of B2Prime, comments:

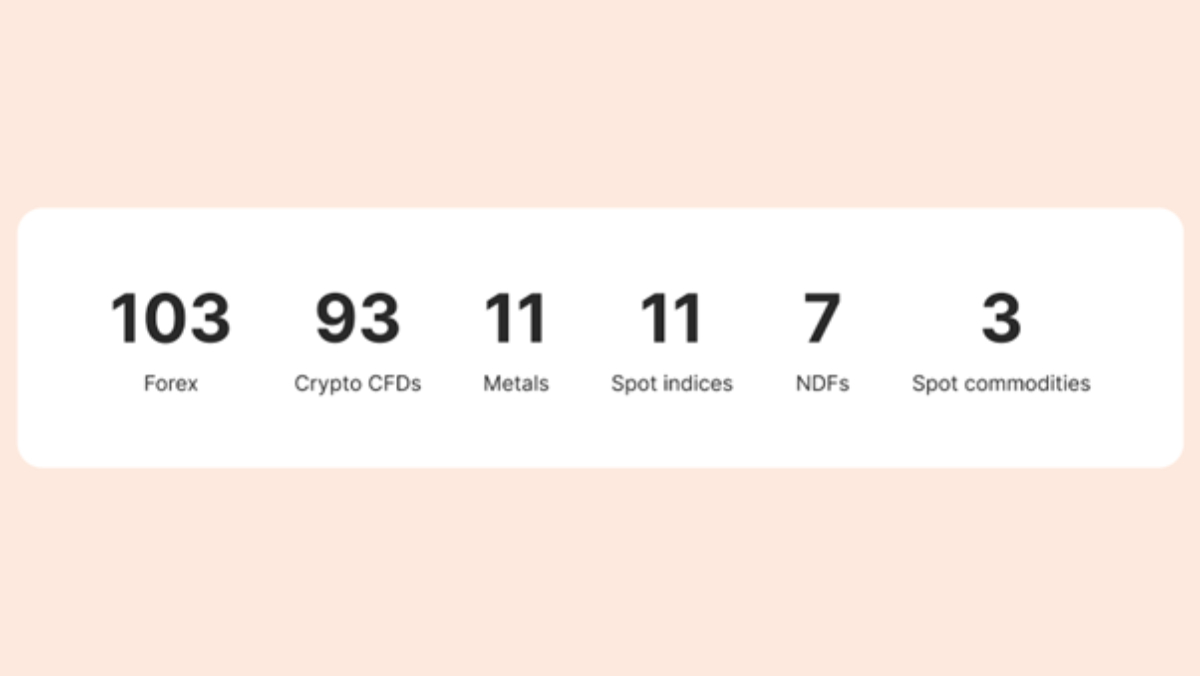

“Our strategic enhancements directly address the needs of institutional clients and market counterparties by bolstering their competitive advantage and expanding their capacity to meet the evolving demands of this industry through our advanced liquidity solutions. Our robust balance sheet (showing 40.32% increase from the previous year with €28,969,690.98 Assets and CET1/Tier 1 ratios, standing at 364.71%, significantly exceeding the regulatory minimums of 56% and 75%) places us at the forefront of the industry. Our commitment to innovation is demonstrated by being the first to offer almost 100 crypto CFD pairs and now starting to offer a 2% margin on major cryptos in response to the growing demand caused by the rapid growth of the crypto market”.

This focused approach ensures that B2Prime’s offerings align with the expectations and requirements of professional clients, adhering to the standards set forth for market transparency and fairness.

More About B2Prime

B2Prime, a leading Prime of Prime Liquidity provider, is licensed in Cyprus, Mauritius, and Seychelles and serves a broad spectrum of professional and institutional clients. These include hedge funds, algorithmic trading funds, alternative investment funds, asset managers, family offices, proprietary trading firms, investment banks, broker-dealers, and other financial intermediaries. The company offers 220+ instruments across 6 major asset classes.

Since its start in Cyprus in 2020, B2Prime has expanded its global footprint, establishing a presence in Mauritius in 2023 and recently securing a securities dealer license in Seychelles. This expansion shows B2Prime’s dedication to providing bespoke liquidity solutions. For entities aiming to leverage these advantages, B2Prime is well-equipped to deliver customised solutions that align with specific business requirements.

Related posts

Hot Topics

Understanding TruthFinder’s Background Check Features

Background checks have become increasingly relevant for personal safety and information gathering in digital environments. TruthFinder offers comprehensive background check…

How MLOps Is Shaping the Future of AI in Business

Artificial intelligence (AI) has evolved from a futuristic idea to a strategic necessity for companies looking to innovate, grow, and…