ULIPs are insurance cum investment plans, allowing the investment of funds to meet your long-term financial obligations along with providing life insurance coverage. The premium amount paid is diverted towards the funds opted for, & the remaining amount is allocated towards life insurance. This plan also offers an option to switch between the funds & your changing requirements. The funds invested generally cannot be withdrawn in the lock-in period, i.e. 5 years, & a surrender fee is charged in case funds are partially withdrawn before 4 years.

If the insured dies suddenly, his nominees will receive the death benefit or the fund value, whichever is higher. In case the insured survives the policy, he will receive the fund value that would have been accumulated depending on the fund’s performance.

Table of Contents

ToggleHow does ULIP work?

After understanding What is ULIP, now let us know how it works:

ULIPs are financial products that combine insurance factors with investment. So, a part of the premium amount paid is diverted towards insurance, & the other one is towards investments in debt, equity, or hybrid funds. Fund managers are appointed to assist professionally in managing funds to help them grow over a period of time. Also, it offers an option to switch between the funds according to the market conditions. At the time of maturity, you will get the total investment value, which will further give security & wealth creation.

Let us now understand how ULIP works with the help of an example:

Mr Rohit buys a ULIP at 30 years of age, having a 30-year policy tenure. The premium amount is partially allocated towards the life insurance, amounting to INR 1 crore, & the remaining is invested towards equity. There exist two cases, as mentioned under:

Case 1: In case Rohit dies at the age of 45 years due to an accident:

In this case, his family members will receive the amount higher of the two, i.e., a death benefit of INR 1 crore or the fund value at the time of his demise, ensuring the beneficiaries get the maximum benefit possible.

Case 2: In case Rohit survives the 30-year policy tenure:

In this case, Rohit will receive the fund value that would have been accumulated depending on the fund’s performance, which will further help you achieve financial objectives.

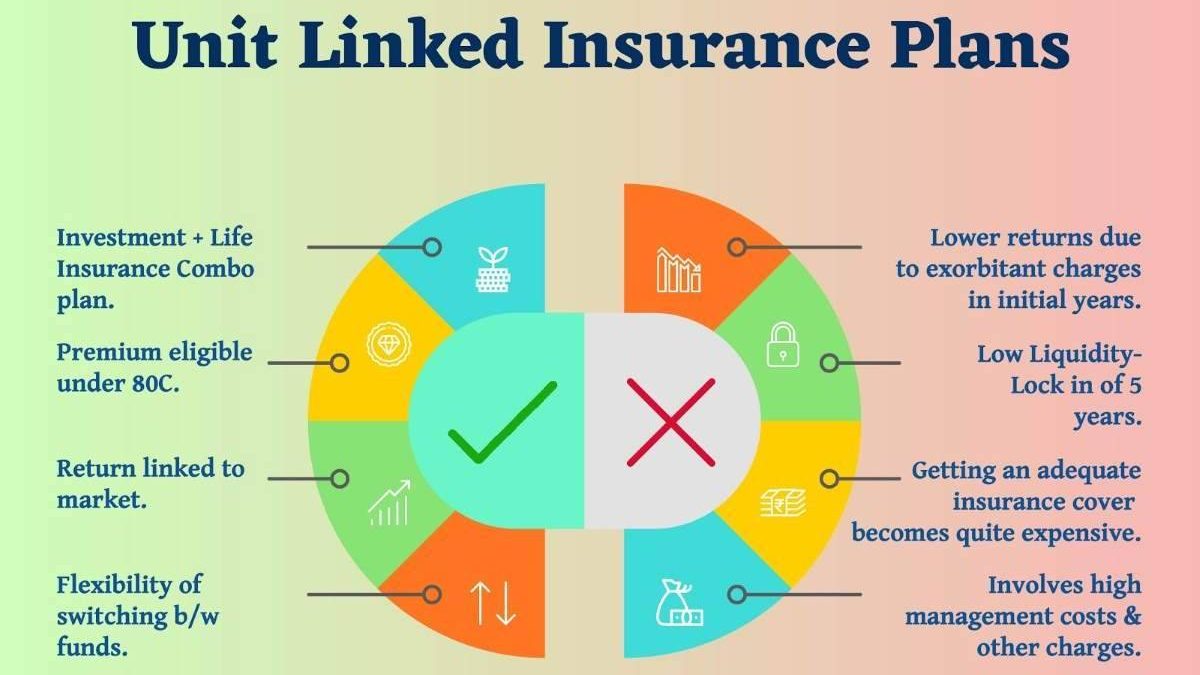

Advantages of ULIP

Provided are the advantages of ULIP:

- Dual Benefits

It offers dual benefits of insurance & investment that provides financial protection & growth.

- Flexibility

You can decide between debt, equity, or hybrid funds depending on the risk appetite.

- Tax Benefits

Get a tax deduction on the premium amount, & the maturity proceeds will attract taxes if the premium amount exceeds 10% of the sum assured.

- Partial Withdraw Option

Once the lock-in period is completed, partial withdrawal of funds is allowed, hence providing liquidity in funds.

- Switching Funds

ULIPs allow switching between funds like equity & debt depending on the market conditions.

- Goal-Based Financial Planning

It helps to achieve long-term objectives, such as retirement, children’s education, wealth creation, etc.

Disadvantages of ULIP

Provided are the disadvantages of ULIP:

- Market-Linked Risk

The returns on investment are market-linked, which makes ULIP a riskier choice than traditional insurance.

- High Initial Charges

The charges, such as premium allocation fees, fund management charges, mortality charges, switching charges, etc., are quite high.

- Extended Lock-in Period

The lock-in period extends to up to 5 years, restricting short-term access to the funds in the short term.

- Complexity

It requires a complete knowledge of insurance & investment, which is complex to understand.

- Lower Returns

The returns offered by ULIPs are lower in comparison to pure equity investments due to their associated charges.

- Surrender Charges

It requires you to incur surrender charges on an early withdrawal, leading to a reduced return on investments.

How to Buy ULIP Online?

Provided are the steps to be followed to buy a ULIP online:

Step 1: The official website of the insurance service provider which offers ULIPs should be visited.

Step 2: Check out all the available ULIP products that best suit your financial objectives & risk tolerance level.

Step 3: You can also use the ULIP Return Calculator on the insurance provider’s website to calculate the premium amount based on the amount of sum assured.

Step 4: Choose the desired policy tenure & the premium amount that best suits your budget & financial goals.

Step 5: Fill out the complete online application form with your personal details, contact details, along with the details of the nominee.

Step 6: Next, depending upon the risk tolerance level, select the type of funds you want to invest your money into.

Step 7: Upload the documents required to be submitted, like address proof, identity proof, & age proof.

Step 8: Choose your preferred mode of payment from the options available, such as net banking, debit card, credit card, wallets online, etc.

Step 9: In case required, complete the verification process online, including the video KYC process.

Step 10: Once the verification & approval are completed, the insurance provider will provide you with the policy document & mail it to the registered e-mail ID.

Conclusion

ULIP is considered to be a mutual funds scheme that comes with the dual benefit of investment & insurance. These plans are market-linked plans, which provide life insurance coverage & offer long-term capital growth along with tax benefits. These plans are meant to meet objective-based planning, such as children’s education, wealth creation, retirement planning, etc. It also provides financial security to the family members & helps meet long-term financial objectives.

Shashi Teja

Related posts

Hot Topics

Understanding TruthFinder’s Background Check Features

Background checks have become increasingly relevant for personal safety and information gathering in digital environments. TruthFinder offers comprehensive background check…

How MLOps Is Shaping the Future of AI in Business

Artificial intelligence (AI) has evolved from a futuristic idea to a strategic necessity for companies looking to innovate, grow, and…